Deposit Rates

Annual Percentage Yield (APY) is accurate as of 1/1/2026, and subject to change at any time without notice.

EZ Interest Checking and EZ Choice Savings* | |||

Description | Minimum to Open | Interest Rate | Annual Percentage |

| EZ Interest Checking*** $1,500 minimum balance to waive $15 monthly fee. | $0.01-$9,999.99 $10,000 + | 2.72% .10% | 2.75% 2.75%-0.37% |

| EZ Choice Savings** $2,500 minimum balance to waive $10 monthly fee. Must have an active EZ Interest Checking Account. | $0.01-$24,999.99 $25,000+ | 0.75% 1.49% | 0.75% 1.50% |

Passbook & Statement Savings Accounts*

| This account offers a competitive variable rate which Milford Federal sets on a weekly basis to reflect market conditions. We offer both passbook and statement savings accounts, and you may deposit or withdraw at any time without notice. You can find out how savings accumulate by using our savings calculator. | |||

Description | Minimum to Open | Interest Rate | Annual Percentage |

| Passbook Savings (Must have passbook to make a withdrawal at the branch) | $10 | .05% | .05% |

| Statement Savings | $10 | .05% | .05% |

Money Market Checking Accounts*

| With earnings rates at higher money market levels, this account is ideal for individuals with higher balances desiring to maintain a high level of liquidity. Minimum to open $10. | ||

Balance to Earn Stated APY | Interest Rate | Annual Percentage |

| $50 - $9,999.99 with monthly service fee of $10 (Minimum to avoid monthly service charge $2,500.00.) | .05% | .05% |

| $10,000 - $24,999.99 | .10% | .10% |

| $25,000 - $49,999.99 | .10% | .10% |

| $50,000 - $74,999.99 | .10% | .10% |

| $75,000+ | .10% | .10% |

Certificates of Deposit** | Minimum to Open | Interest Rate | Annual Percentage | |

| 3 Months | $1,000 | .10% | .10% | Open Account Now |

| 5 Months | $1,000 | 3.93% | 4.00% | Open Account Now |

| 6 Months | $1,000 | 3.20% | 3.25% | Open Account Now |

| 9 Months | $1,000 | 3.20% | 3.25% | Open Account Now |

| 12 Months | $1,000 | 3.20% | 3.25% | Open Account Now |

| 18 Months | $1,000 | .20% | .20% | Open Account Now |

| 24 Months | $1,000 | 3.20% | 3.25% | Open Account Now |

| 36 Months | $1,000 | 3.20% | 3.25% | Open Account Now |

| 36 Month Home Buyer CD | $500 | 2.00% | 2.02% | |

| 36 Month Education CD | $500 | 2.00% | 2.02% | |

| 48 Months | $1,000 | 3.30% | 3.35% | Open Account Now |

| 60 Months | $1,000 | 3.40% | 3.45% | Open Account Now |

| 1-1/2 Year IRA* | $25 | .10% | .10% |

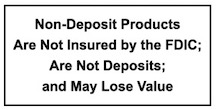

All CD types are available for IRA accounts. Deposits are accepted from residents of Massachusetts, Rhode Island and Windham County Connecticut only. All accounts are subject to approval, and MFB reserves the right for any reason to refuse a deposit or to return all or any part thereof. Each depositor insured to at least $250,000 by the Federal Deposit Insurance Corporation.

Funds Availability Policy Disclosure

Important Information About Procedures for Opening a New Account