Borrow smarter – put your home’s equity to work!

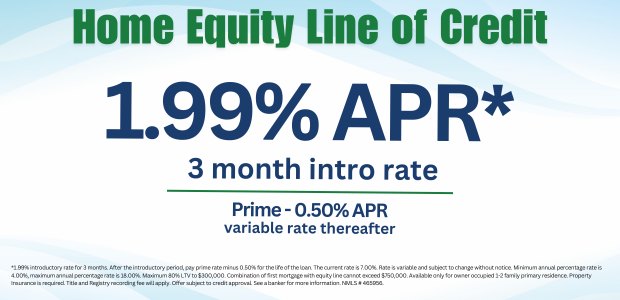

Are you ready to turn your home equity into financial flexibility? We’re excited to offer a highly competitive introductory rate of just 1.99% APR.* Whether you’re looking to renovate your home, consolidate debt, or fund a major purchase, our HELOC can provide the financial support you need.

Why use a HELOC? Your cost of borrowing can be far less than credit cards and loans, and you only pay interest on what you spend. Interest is often tax deductible (applicants should check with their tax advisor). Accessing your HELOC is easy – just write a check or transfer funds to your checking account with online banking.**

No application, processing, or membership fees, and interest is charged only on the amount you actually borrow with our revolving home equity line of credit. Lines are available for amounts ranging from a minimum of $10,000 to an amount not to exceed $750,000 when combined with the first mortgage.

Terms And Conditions

*1.99% introductory rate for 3 months. After the introductory period, pay prime rate minus 0.50% for the life of the loan. The current rate is 7.00%. Rate is variable and subject to change without notice. Minimum annual percentage rate is 4.00%, maximum annual percentage rate is 18.00%. Maximum 80% LTV to $300,000. Combination of first mortgage with equity line cannot exceed $750,000. Available only for owner occupied 1-2 family primary residence. Property Insurance is required. Title and Registry recording fee will apply. Offer subject to credit approval. See a banker for more information. NMLS # 465956.

** Requires online banking enrollment