Tax deferred annuities are retirement savings vehicles, designed specifically to address the uncertainties of retirement income planning:

- How much money will I need to live a comfortable retirement?

- Will I outlive my income?

- How can I protect my family after I am gone?

Fixed Annuities

Fixed annuities are issued and guaranteed** by insurance companies. They offer competitive interest rates, with all the interest accumulating tax-deferred for the life of the annuity. In this way, your earnings remain in your annuity and compound without being taxed, so your money could earn more over time, as expenses and rates can negate some returns and provided no withdrawals are taken.

Immediate Annuities

Immediate annuities are contracts, between an individual and an insurance company. With an immediate annuity, you exchange a lump-sum of money for a guaranteed income stream. The insurance company takes ownership of your money, and agrees to pay you a set amount of income, for a pre-determined amount of time.

Indexed Annuities

With an Indexed Annuity, the interest earnings are tied to the performance of an equity index such as the S&P 500 or the Dow Jones Industrial Average. With an Indexed Annuity, your interest earnings may increase if the market performs well, but if the market performs poorly, your principal is not reduced by market losses.

To learn more about annuities and how they may help you reach your retirement goals, contact Alan at 508-381-5212.

*We do not provide tax advice. Consult your tax preparer for your particular situation. **Guarantees are based on the claims paying ability of the issuing company.

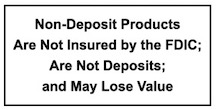

Investment and insurance products and services are offered through Osaic Institutions, Inc., Member FINRA/SIPC. Osaic Institutions and the bank are not affiliated. Products and services made available through Osaic Institutions are not insured by the FDIC or any other agency of the United States and are not deposits or obligations of nor guaranteed or insured by any bank, or bank affiliate. These products are subject to investment risk, including the possible loss of value. *We do not provide tax advice. Consult your tax preparer for your particular situation.