529 savings plans are tax-advantaged education savings vehicles and one of the most popular ways to save for college today. They can also be used to save for K-12 tuition. Much like the way 401(k) plans changed the world of retirement savings a few decades ago, 529 savings plans have changed the world of education savings.

Tax advantages and more

529 savings plans offer a unique combination of features that no other education savings vehicle can match:

- Federal tax advantages: Contributions to a 529 account accumulate tax deferred and earnings are tax free if the money is used to pay the beneficiary’s qualified education expenses. (The earnings portion of any withdrawal not used for qualified education expenses is taxed at the recipient’s rate and subject to a 10% penalty.)

- State tax advantages: States are free to offer their own tax benefits to state residents, such as a tax deduction for contributions.

- Unlimited participation: Anyone can open a 529 savings plan account, regardless of income level.

- Wide use of funds: Money in a 529 savings plan can be used to pay the full cost (tuition, fees, room and board, books) at any college or graduate school in the United States or abroad that is accredited by the Department of Education, and for K-12 tuition expenses up to $10,000 per year.

With so many plans available, it may be helpful to consult an experienced financial professional who can help you select a plan and pick your plan investments. In fact, some 529 savings plans are advisor-sold only, meaning that you’re required to go through a designated financial advisor to open an account.

To learn more about college savings plans and how they may help you reach your goals, contact Alan at 508-381-5212.

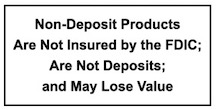

Depending on your state of residence, there may be an in-state plan that provides state tax and other state benefits, such as financial aid, scholarship funds and protection from creditors, not available through a 529 plan. Before investing in any state’s 529 plan, investors should consult a tax advisor. Investment and insurance products and services are offered through Osaic Institutions, Inc., Member FINRA/SIPC. Osaic Institutions and the bank are not affiliated. Products and services made available through Osaic Institutions are not insured by the FDIC or any other agency of the United States and are not deposits or obligations of nor guaranteed or insured by any bank, or bank affiliate. These products are subject to investment risk, including the possible loss of value. *We do not provide tax advice. Consult your tax preparer for your particular situation.